Introduction

In the evolving landscape of econometrics, panel data—a dataset that tracks multiple entities over time—has long been a gold standard for understanding dynamic economic behaviors. From evaluating policy impacts to forecasting market trends, its ability to capture both cross-sectional and temporal variations makes it indispensable. However, the rise of machine learning (ML) is reshaping how economists leverage panel data. This article explores the groundbreaking fusion of ML and panel data analysis, its applications, challenges, and future potential, offering a fresh perspective on this transformative synergy.

1. The Legacy of Panel Data in Econometrics

Panel data, often called longitudinal data, combines observations across individuals, firms, or countries (cross-sectional) and time periods (time-series). Traditional models like fixed-effects, random-effects, and dynamic panel models (e.g., Arellano-Bond) have addressed issues such as unobserved heterogeneity and autocorrelation. For decades, these methods have powered studies on topics like wage growth, firm productivity, and policy evaluation.

Why Panel Data Matters

- Controls for unobserved variables (e.g., cultural factors in cross-country studies).

- Captures dynamic relationships (e.g., how past investments affect future profits).

- Enables causal inference through methods like difference-in-differences (DiD).

Despite its strengths, traditional panel analysis struggles with high-dimensional data, non-linear relationships, and complex interactions—limitations that machine learning is now addressing.

2. Machine Learning’s Emergence in Econometrics

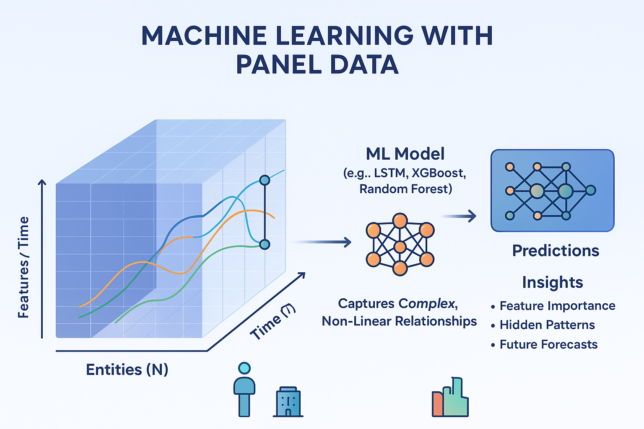

Machine learning, a subset of artificial intelligence (AI), excels at identifying patterns in large, complex datasets. Techniques like random forests, neural networks, and LASSO regression have gained traction in economics for tasks such as prediction, classification, and variable selection. Unlike classical econometrics, which prioritizes causal inference, ML focuses on predictive accuracy. However, recent advancements are bridging this gap.

Key ML Techniques Adaptable to Panel Data

- Double/Debiased Machine Learning (DML): Isolates causal effects in high-dimensional settings.

- Synthetic Control: Creates “synthetic” counterfactuals for policy analysis.

- Reinforcement Learning: Optimizes dynamic decision-making processes (e.g., adaptive pricing strategies).

3. The Fusion: ML-Enhanced Panel Data Analysis

The integration of ML with panel data is unlocking new possibilities:

A. Tackling High-Dimensionality

Modern datasets often include thousands of variables (e.g., firm-level ESG metrics, satellite imagery for crop yields). ML algorithms like LASSO and gradient boosting automatically select relevant predictors, reducing overfitting. For example, a study on corporate bankruptcy might use ML to identify non-linear relationships between debt ratios, market conditions, and regulatory changes across 10,000 firms over 20 years.

B. Improving Causal Inference

While ML is not inherently causal, methods like DML and causal forests are being adapted for panel settings. Consider evaluating a universal basic income (UBI) pilot: DML can control for time-varying confounders (e.g., inflation, employment trends) while estimating the treatment effect on household savings.

C. Uncovering Heterogeneous Effects

Traditional models often assume uniform treatment effects. ML, however, identifies subgroups with varying responses. For instance, an ML-panel model might reveal that a carbon tax reduces emissions more effectively in manufacturing-heavy regions than agricultural ones.

D. Forecasting with Precision

ML’s predictive power enhances forecasts in panel contexts. Central banks now use hybrid models to predict GDP growth by combining historical panel data with real-time indicators like social media sentiment.

4. Real-World Applications

A. Climate Policy Evaluation

Governments are using ML-panel models to assess the long-term impact of carbon pricing. By analyzing decades of emissions data across countries, algorithms predict how tax rates influence renewable energy adoption while controlling for geopolitical shifts.

B. Healthcare Outcomes

Hospitals leverage panel data to track patient health over time. ML algorithms analyze variables like treatment protocols, demographics, and genetic data to personalize therapies. For example, a panel study on diabetes patients might use ML to optimize insulin dosage schedules.

C. Financial Stability

In finance, ML-panel models predict firm-level risks by integrating balance sheet data, market trends, and macroeconomic indicators. During the COVID-19 pandemic, such models helped banks identify vulnerable SMEs needing liquidity support.

5. Challenges and Ethical Considerations

A. The “Black Box” Dilemma

ML models, especially deep learning, are often criticized for lacking interpretability. While a neural network might accurately predict inflation, policymakers need transparent reasoning. Solutions like SHAP values and LIME are being integrated to explain ML-driven insights.

B. Overfitting and Reproducibility

ML models may overfit panel data, producing results that fail in real-world scenarios. Robust cross-validation and out-of-sample testing are critical.

C. Data Privacy

Panel datasets often include sensitive information (e.g., household income). Federated learning—a technique where models are trained across decentralized data—is emerging as a privacy-preserving alternative.

D. Computational Costs

Training ML models on large panel data requires significant resources. Cloud computing and quantum algorithms promise to alleviate this burden.

6. The Future of ML-Panel Data Synergy

A. Quantum Computing

Quantum algorithms could revolutionize panel analysis by solving complex optimizations (e.g., high-dimensional fixed-effects models) in seconds.

B. Federated Learning

This approach enables collaborative model training without sharing raw data—ideal for cross-country panel studies on topics like tax evasion.

C. Ethical AI Governance

As ML-panel models influence policy, frameworks for accountability and fairness (e.g., bias audits) will become essential.

7. Case Study: Remote Work Productivity Post-Pandemic

A 2023 study combined panel data from 500 firms with ML to analyze remote work’s impact. Using natural language processing (NLP) on employee surveys and productivity metrics, the model found that hybrid work increased output in tech sectors but decreased it in manufacturing. Such granular insights guide HR policies tailored to industry needs.

Conclusion

The marriage of machine learning and panel data is redefining econometrics, offering unparalleled precision in causal inference, prediction, and heterogeneity analysis. While challenges like interpretability and ethics persist, advancements in explainable AI and quantum computing promise to overcome these hurdles. For economists, embracing this synergy is no longer optional—it’s imperative to stay relevant in a data-driven world. As the field evolves, interdisciplinary collaboration will be key to harnessing its full potential responsibly.